September 21, 2021

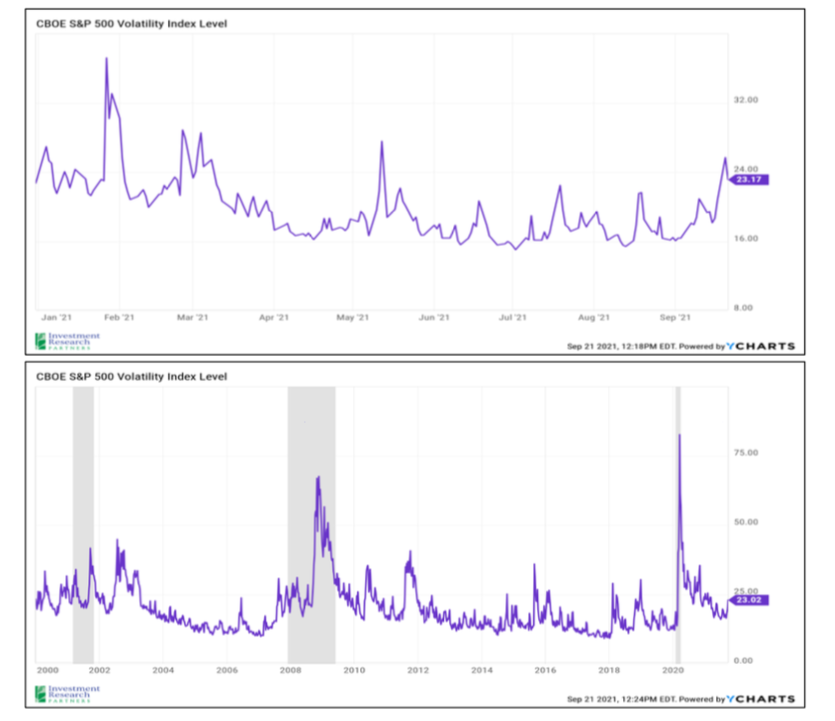

After a muted summer, market volatility has returned again in September. The CBOE VIX Index measures the implied volatility of the S&P 500 market index and is sometimes referred to as a “fear gauge” because it measures the range of outcomes expected by investors for the stock market. So, a higher VIX translates to increased expectations for large potential swings of the S&P 500. On Tuesday, September 20, the VIX spiked to over 25 which was the highest reading since May. The first chart below highlights the level of the VIX year- to-date. For a longer-term perspective, the second chart includes history for the VIX going back to the beginning of the century. The recent increase in expected future volatility has certainly caught investor attention, but the current level of the VIX remains fairly close to the long-term average reading of approximately 20.

Historical Perspective on Volatility

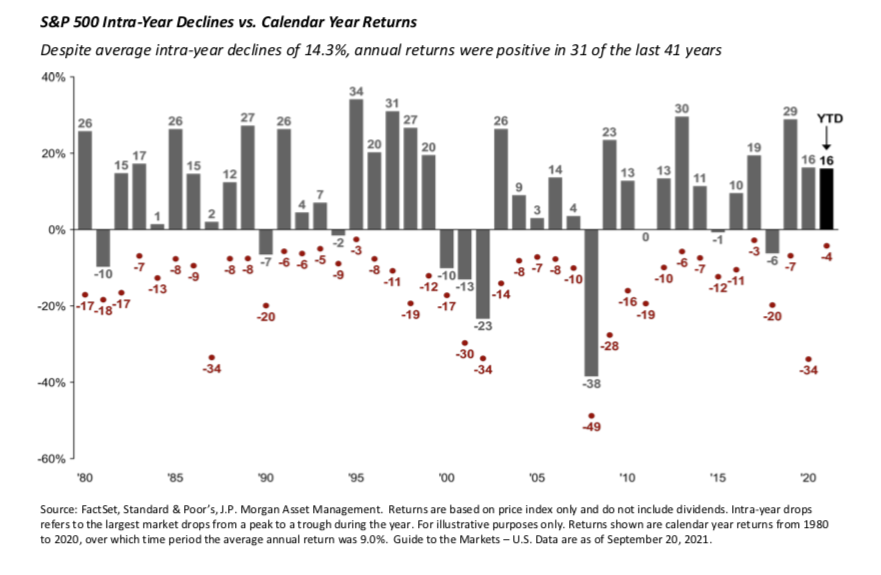

Volatility is a normal and frequent attribute of investing in equity markets, so this recent spike in volatility is not surprising. If anything is unusual about 2021 it may be the lack of any significant pullback in equity markets to this point. As mentioned previously, market volatility is a normal part of investing. The chart below shows the returns in each calendar year for the S&P 500 Index in the gray bars and the largest intra-year drop below in the red dots. As noted, although the market has finished in positive territory most years, the average intra-year decline has been over 14%. The largest pullback for 2021 has been just 4%.

Current Drivers of Uncertainty

Volatility is ultimately driven by a wide array of interconnected factors; below are some of the major developments that may be driving volatility in September and potential sources of additional volatility in the months ahead.

- Federal Reserve Tapering Decision – in response to the COVID-19 crisis, the Fed has provided markets with massive amounts of liquidity. Markets have benefitted from lower interest rates and bond purchasing (quantitative easing). The Fed is discussing slowing down (tapering) bond purchases. Markets are concerned about implications of this support being removed, namely the potential for higher borrowing costs.

- COVID – just when investors thought COVID-19 had become a back-burner event, the delta variant has been causing rising infection and hospitalization rates in many parts of the country. As we head into flu season in the northeast, markets are discounting the risk of renewed restrictions impacting the economy.

- China Contagion Concerns – One of China’s largest developers, Evergrande, faces liquidity issues creating a significant potential debt default. Investor memories of the financial crisis loom large. While there are additional safeguards in place that reduce the risk of contagion, it remains an area of investor concern.

- Potential Debt Ceiling Showdown & Tax Policy Uncertainty – in 2011, the U.S. came to the brink of potential default during a political showdown over raising the debt ceiling. That resulted in the first ever credit downgrade for U.S. government debt. The debt ceiling has come back into focus yet again. In addition, a number of potential tax changes are being deliberated in Washington. Higher corporate tax rates and capital gains rates weigh on investor minds given the potential for these actions to reduce the after-tax profitability of companies as well as the after-tax gain on realized investments.

- Inflationary Pressures – as demand in many industries has recovered more quickly than anticipated, suppliers have been playing catch up, and often still managing through COVID restrictions, worker shortages, and difficulty sourcing raw materials. This has resulted in delays and parts shortages in many different industries and driven prices higher for consumers and businesses.

- Elevated Market Valuations – with the strong recovery following COVID-19, many equity markets and sectors are trading above long-term averages when evaluated with traditional valuation metrics. During environments when valuations are elevated due to a perceived lack of risks, there may be greater potential for sudden downward price adjustments when new risks are presented that could impact the expectation for future economic activity and corporate profitability.

Areas of Opportunity

As we have discussed in previous communications, we currently view the opportunity set in markets as relatively balanced between risk and reward. Some of the positives we currently observe include:

- Healthy Economic Backdrop – from new manufacturing orders to home prices to employment metrics, the economy remains very healthy. The Leading Economic Index continues to point to robust future growth in the U.S. economy.

- Strong Consumer Position – Household net worth is at all-time highs, the percentage of income servicing household debt is at multi-decade lows, the amount of money market balances sitting on the sidelines is historically high. Consumers drive roughly two-thirds of economic activity and they remain in good shape.

- Additional Potential Stimulus – although the Fed is discussing tapering, interest rates remain very low and supportive of growth. In addition, the prospects for additional fiscal stimulus in the form of a significant infrastructure bill remains very possible.

- Strong Corporate Earnings – there is an adage that stock prices follow earnings and company earnings have been roaring back post COVID. Earnings and revenue numbers have been surprising to the upside and the estimates for 2021 are for a significant increase versus both 2020 and 2019.

Summary

Volatility is a frequent and expected component of equity market investing. Volatility can feel especially uncomfortable when it follows a period of relative price stability or steadily rising markets. If anything, 2021 has been unusually calm in that regard. There are always a wide array of factors impacting market concerns. We continue to monitor a number of market risks and opportunities and make decisions following a disciplined, thoughtful approach to long-term investing.