Higher than expected inflation data reported for August surprised the market, showing that lower energy prices have not been enough to offset the impact of higher core prices. A 75-basis point rate increase appears to be fully priced into the market ahead of the September 21st Federal Reserve meeting.

The Bureau of Labor Statistics published the most recent data for the Consumer Price Index (CPI) and its underlying components on September 13, 2022. This is the most commonly cited measure of inflation and is being closely watched as a key metric the Federal Reserve Board (Fed) uses when determining the appropriate level of rate increases.

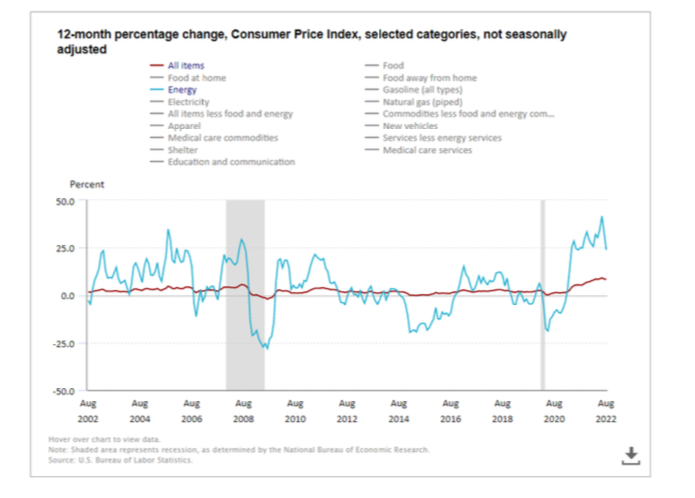

The CPI report this week showed the index advanced 0.1% over the last month on a seasonally adjusted basis after being unchanged in July. Over the last 12 months, the increase was 8.3%. The market expectation was for a drop in month over month CPI of 0.1%, so the report two tenths higher sent equities lower and bond yields higher. The core CPI, which excludes food and energy, rose 0.6% as compared to the consensus expectation of 0.3%.1 Despite the relatively small monthly increase, this represents a shift in sentiment from last month’s positive report and shows that inflation overall may not have peaked just yet despite the drop in energy prices (shown in blue in the chart below).

The CPI data has taken on increased importance as the Fed continues to emphasize the need to bring inflation back under control, potentially causing some economic pain along the way. This is the last significant inflation release ahead of the Fed meeting next week, and a 75-basis point rate increase is now fully priced in, as shown by Fed funds futures on Bloomberg. After the release, there is even a small chance of a 100-basis point increase shown in the futures pricing. We do not think this is a likely outcome, but it shows the influence of CPI data and underscores concern for more aggressive Fed rate increases.

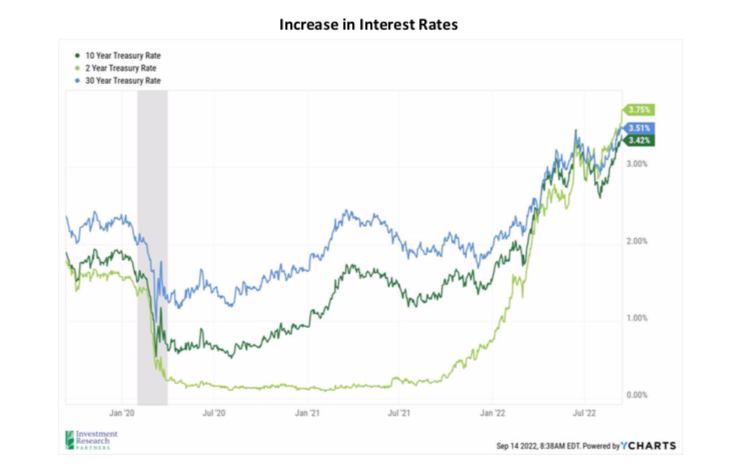

The question remains whether the Fed will be able to reduce overall inflation without too much negative impact on the economy. This is shown in part through higher borrowing costs, with the 2-year Treasury note yield rising to approximately 3.75%, the highest level in nearly 15 years. Other risk assets, including the stock market, may also react negatively to a slowing economy, so we would not be surprised if volatility continues. There is one more CPI report ahead of the Fed’s next meeting in November, and all eyes will look ahead to anticipate the future path of rate increases.

1 https://www.bls.gov/cpi/

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.