Sense making in today’s world is a difficult task. Whether you are trying to make sense of markets, politics, or just life in general, we are awash in a world full of data and differing “expert” opinions. Social media and targeted advertising can add to the confusion, nudging us this way or that based on their self-serving purposes. It seems harder than ever to identify the signal in a world full of noise.

Nexus is defined as – “a connection or series of connections linking two or more things.”1 The objective of the Nexus series of notes is to look for connections, whether they be stories from the past or lessons learned in other fields, to help us tackle today’s challenges, remembering the adage, “history does not repeat itself, but it often rhymes”. While we will typically be applying these lessons to investment markets, we will seek to draw inspiration from a broad range of subjects and thought leaders. Our hope is that by occasionally unplugging from mainstream media’s incessant buzz and seeking out timeless lessons and patterns, we can approach the problems of the day with a wiser and more nuanced perspective.

This first note will focus on an issue that we have been wrestling with recently – how to weigh ethical and moral considerations when exploring investment opportunities in exponential technology and health care innovation. Artificial intelligence (AI), gene editing, autonomous vehicles, the metaverse, longevity research pushing the bounds of immortality – the promise of such advancements is hard to ignore, both as an investor and as a member of society. Who doesn’t want to offload menial work to a machine or to live longer and healthier lives unincumbered by the issues that old age currently presents? Maybe 80 will be the new 40 in the not-so-distant future! And potentially being an early investor in a company that cures cancer sounds attractive, as well.

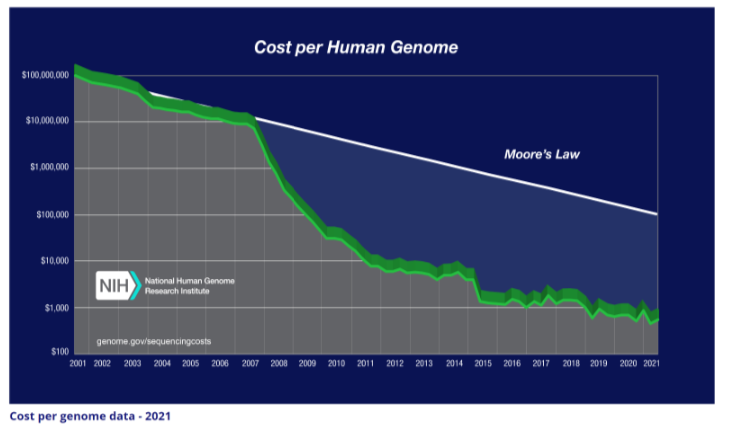

While the promise of a better future is nothing new, the pace at which these projects, backed by ever- advancing computing power, are now moving is. Moore’s law is an observation about how quickly the semiconductor industry advances, with the number of transistors on an integrated circuit doubling about every two years. This observation equates to a compound annualized growth rate of about 41 percent and it has held for decades.2 This acceleration in computing power has helped drive advancements in multiple other areas, as well. Consider the plummeting cost to sequence the human genome over time, at right.

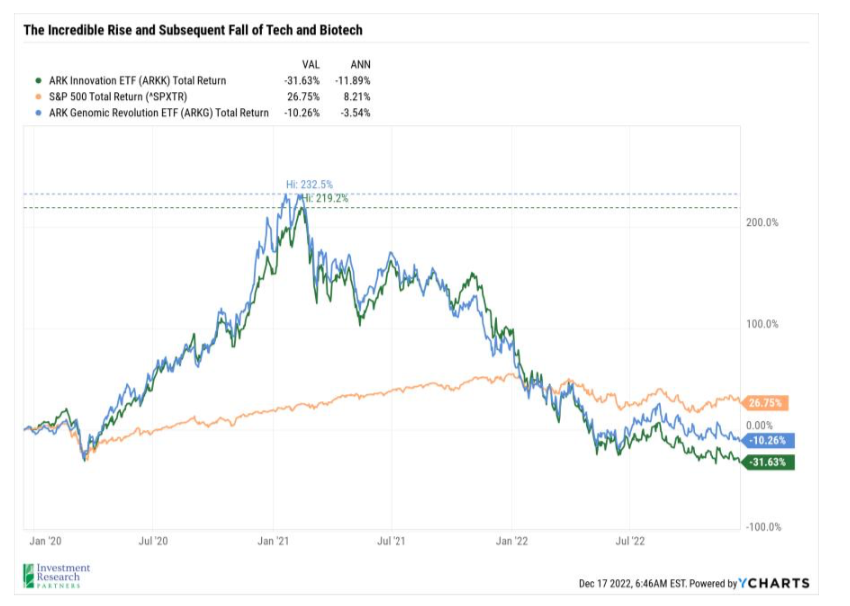

While innovation continues at a staggering pace, investments in exponential technology and biotechnology have plummeted over the course of the year, underperforming traditional markets by a wide margin. For example, two exchange traded funds (ETFs) managed by ARK, one focused on disruptive technology (Innovation ETF) and one on advancements in genomics (Genomics Revolution ETF), illustrate the point.3 Both ETFs more than tripled in value coming out of the Covid-19 pandemic lows (see green and blue lines), but have subsequently fallen to such an extent that they are now both trailing the S&P 500, a proxy for large cap US stocks (gold line), over the past three years.

Given both the promising advancements in cutting-edge tech and biotech and the significant sell-off in both spaces over the past year, we find both sectors to be potentially attractive for long-term investors that are comfortable with volatility. However, for every promise of how great life will be in the future and how much money can be made investing in those promises, we have stories, both fiction and non-fiction, that warn us of our hubris. In fact, the consequences that come from people trying to play a divine role is one of THE human stories that has resonated with societies over the course of written history.

That lesson can be found everywhere you look – in religions, myths passed down over centuries, great works of fiction, and blockbuster movies. For example, the great Gilgamesh is humbled by death (statue at right), Adam is thrown out of the Garden of Eden, Icarus falls from the sky, Frankenstein’s monster gets loose, and Jurassic Park is overrun with dinosaurs. Even this note’s title pays homage to the famous Aldous Huxley novel by the same name, which portrays a frightening vision of a future that looks nothing like the utopia that was promised.4

A common misperception is that technology innovation only disrupts the technology sector. If you take nothing else from this note, please consider the following generalizations we have made following technology over time: 1) technological innovation impacts every part of the

economy, every part of the market, and nearly every part of our lives, 2) technology can serve

to amplify and consolidate power – whether good or bad, and 3) progress is difficult to stop and nearly impossible to reverse.

Consider the first point – it wasn’t that long ago but imagine going back to a time before the internet and cell phones. We carried maps in our car in case we got lost, spent hours walking around malls looking for gift ideas, and referenced dictionaries and encyclopedias for information. Now cell phones and search engines put all of that information at our fingertips. Speaking of information, think of the power that firms like Google, Facebook, and Amazon now have over us (second point). They may know more about us than our closest friends based on our internet search and shopping histories.

Lastly, progress rarely moves backward. You can’t “unring the bell” by uninventing the atomic bomb or turning off the internet any more than you can stop artificial intelligence or ask everyone to forget what has been learned about DNA sequencing. You can attempt to regulate it, but history suggests that the metaphorical genie never goes back into the bottle.

It is also important to note that “progress” can be, but isn’t always a good thing. For all the benefits AI and genomic advancements could bring, there are applications that are potentially immoral and terrifying. Consider the accusations against China for using the power of facial recognition and AI to turn the Xinjiang region into a police state to detain the Uighur population in the name of anti-terrorism.5 Or the moral dilemma brought about by gene editing as scientists try to determine what genes should be edited out of our population forever.6 With great power should come great responsibility, but unfortunately, that is not always the case.

So how does a responsible citizen and investor proceed when confronted with both the potential promise of such advancements in technology and biotechnology, along with the potential peril they may introduce in the world? Yuval Noah Harari’s non- fiction Sapiens, a sweeping history of humankind, confronts a similar question as it seeks to imagine where humankind, made almost godlike with its recent command of technology, is going. In part, Harari ends the novel by answering the question as follows:

“The only thing we can try to do is to influence the direction scientists are taking.”7

As investors, we choose to answer our question in a similar manner; we choose to be Intentionally Invested. When you look at technological advancement over time, it rarely leads to binary good-or-bad results. It is typically a bit of both. For example, we would argue that the internet is neither entirely good nor entirely bad for mankind, there are features that have been a blessing and others a curse. Given the litany of cautionary tales about the promise of disruptive technology, being intentionally invested to us means investing alongside experienced, active, ethical, and engaged firms whenever possible when committing capital to rapidly changing fields. By partnering with such firms, we seek to make wise, measured, and ultimately, profitable investment decisions on your behalf.

As 2022 comes to an end, we wish you all happy holidays and a wonderful New Year. It has been a challenging year for investors, but we believe brighter days are ahead. As always, we appreciate the trust you place in our firm as we navigate the difficult questions investing presents, and we are excited to continue our partnership in the New Year and beyond.

1 Source: Oxford Languages

2 Source: Moore’s law – Wikipedia

3 For illustrative purposes only, IRP does not currently invest in or recommend either of these securities 4 Source: Brave New World – Wikipedia

5 Source: How China Is Using Facial Recognition Technology : NPR

6 Source: The Dark Side of CRISPR – Scientific American

7 Source: Sapiens – A Brief History of Humankind

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.