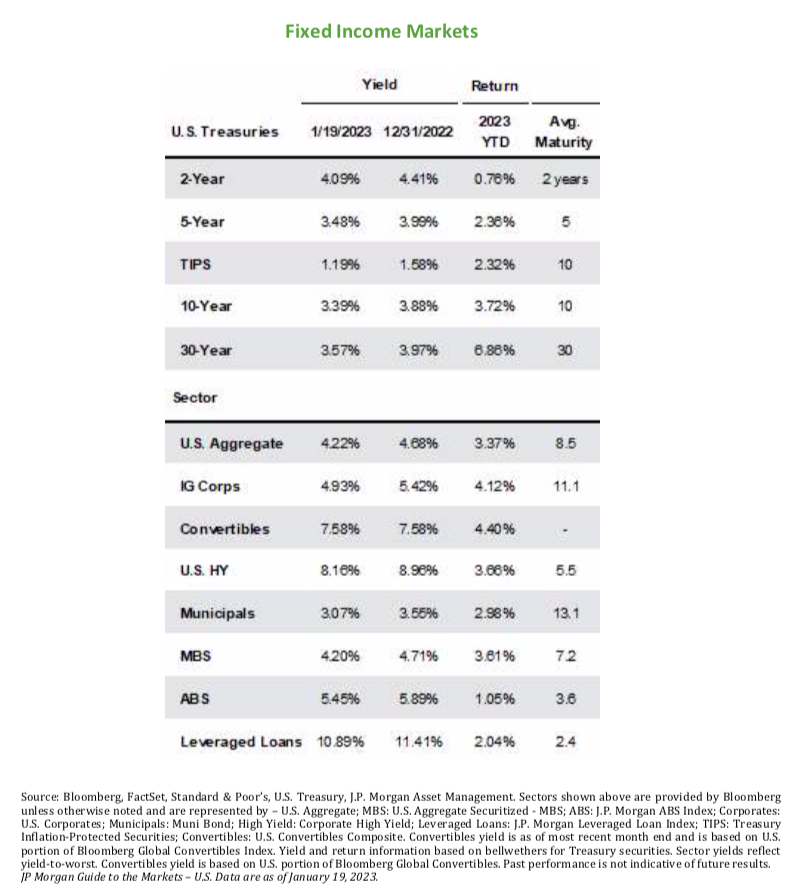

Previous editions of Bond Basics served as an introduction or re-introduction to a market that may have been ignored more recently due to the extended period of historically low interest rates. While acknowledging the rapid rise in rates was painful in a variety of ways, we concluded with reasons for optimism and highlighted that savers, conservative investors, and individuals who depend on a fixed income for their daily expenses will benefit as there is now a relatively attractive alternative to stocks and other more risky assets. 2023 has, so far, offered a welcome reset for bond holders with about a 3% rally to start the year (following a decline of roughly 13% in 2022)1. Remembering that bond prices and yields have an inverse relationship, this means that the yield on a fixed income investment purchased today would be lower than it was at year- end. Nevertheless, yields remain near the highest levels in the last decade, especially on the short end of the maturity yield curve (the blue line at left). A conservative investor could currently lock in a yield of 4- 5% for a low-risk portion of their fixed income portfolio, which we believe could be valuable as volatility is likely to persist in the coming months as the Federal Reserve continues to navigate the fight against inflation.

This edition of Bond Basics will dive into one of the ways that investors can safely participate in the current yield environment: Brokered Certificates of Deposit (CDs). Backed by the Federal Deposit Insurance Corporation (within applicable limits), CDs are a fixed income instrument that may offer additional yield and diversification as compared to other low-risk investments such as money market accounts and US Treasury bonds.

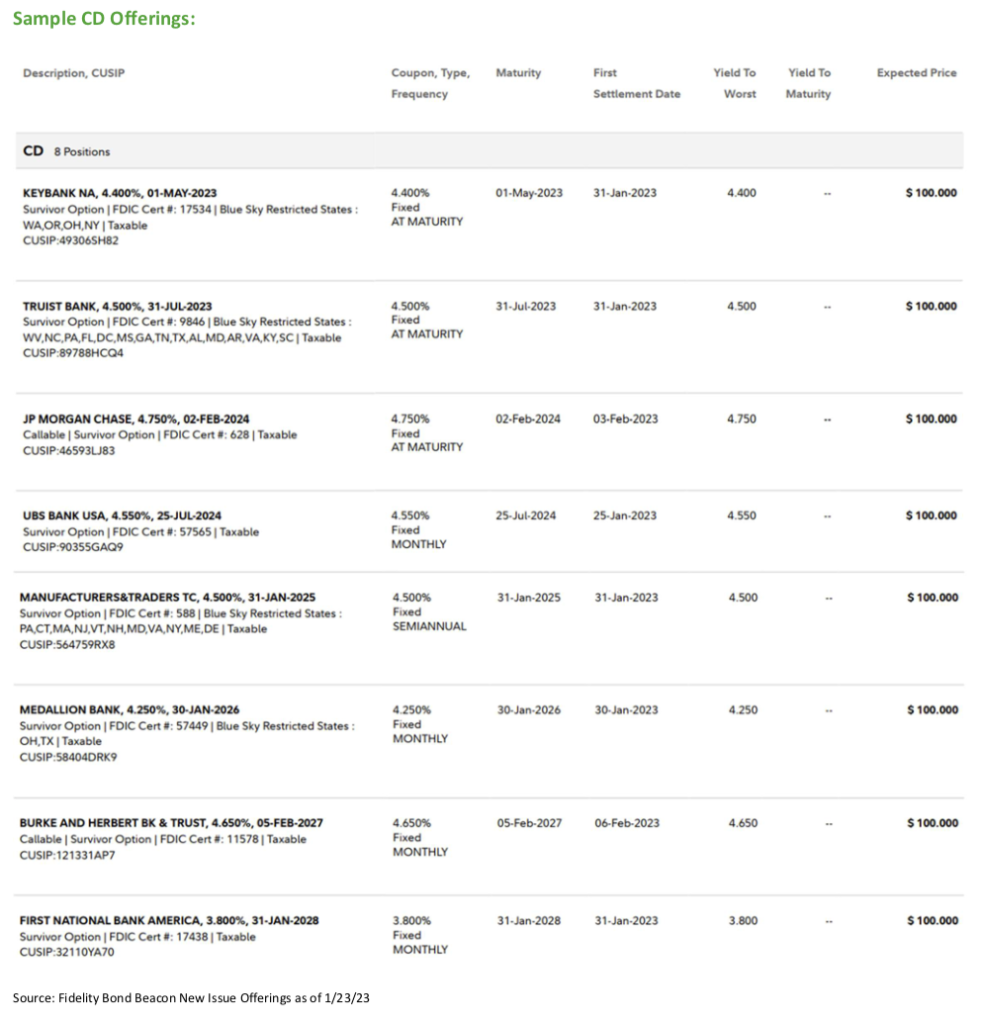

For reference, we have included a current list of sample brokered CD offerings below. While it is difficult to forecast short- term movements in the yield curve, we believe that volatility is sure to persist, and these rates will move around as a result. However, the current environment could offer an attractive entry point for fixed income investment or an appropriate time to rebalance back to a “normal” allocation for a balanced portfolio. Please do not hesitate to reach out if you would like to create a custom ladder of brokered CDs or other fixed income investments such as US Treasury securities and municipal bonds in order to meet your needs.

Benefits of Brokered CDs:

• FDIC insured up to $250,000 per individual, per bank: an investor can diversify by buying CDs issued by a variety of banks to be held and managed in one investment account.2

• Potential for higher yield/return compared to savings account, money market or Treasuries (considered to be a “riskless” investment).

• Liquidity: Unlike brokered CDs, CDs purchased directly from a bank frequently have prepayment penalties if an investor needs to withdraw the money prior to maturity, and there is no secondary market. Brokered CDs can be bought and sold in the secondary market. As such, a holder is subject to market risk (investor could have a profit or loss depending on the current market compared to when the CD was purchased) but has the option to sell a CD if the capital is needed prior to maturity. No gain or loss will be realized if the CD is held to maturity.

• Predictable cash flow: CDs typically offer a fixed-rate coupon and could pay monthly, semi-annually, or at maturity. We would suggest a laddered maturity schedule to match cash flow with custom portfolio needs. As CDs mature, the investor has the flexibility to decide whether reinvestment in another CD is appropriate, could pursue other investment opportunities, or use the money for another purpose.

• Flexibility in structure as desired: As is typical with financial products, CDs can be structured with various features such as longer maturities or call features which could potentially offer additional yield pick-up in exchange for longer duration or optionality.

• Survivor Option: If an investor passes away while holding the brokered CD, his or her heirs can “put” or redeem the CD back to the bank at full face value with no penalty.3

1 Source: YCharts US Aggregate Bond ETF and US Treasury Bond ETF Total Returns as of 1/23/23

2 FDIC: Are My Deposit Accounts Insured by the FDIC?

3 Death Put Definition (investopedia.com)

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.