Today’s CPI report showed a year-over-year increase of 6.4% for the all-items index, before seasonal adjustment. This comes in slightly higher than market expectations, but it is still a decline from last month (6.5% in December) and continues the trend downward since the peak in June. However, the shelter subcomponent remains stubbornly high and was the largest contributor by far to the monthly all-items increase. This report is unlikely to change the Fed’s “higher for longer” narrative, as it is largely in line with recent statements that inflation has eased somewhat but remains elevated.

The Consumer Price Index (CPI), published by the Bureau of Labor Statistics on a monthly basis, continues to receive tremendous focus amongst market participants as the most commonly cited measure of inflation and a key metric used by the Federal Reserve Board (Fed) when determining the appropriate level of rate increases. As we have discussed in previous pieces, relentless inflation in 2022 forced the Fed to increase the Fed Funds Target Rate at a record pace, leading to a painful repricing in nearly every asset class. The Fed Funds rate influences the rates provided for many short-term assets such as savings accounts, CDs, and US Treasury Bills. Raising and lowering this rate is the Federal Reserve’s primary tool in seeking to promote economic stability. In 2020, the rate was lowered to nearly zero in order to ease financial conditions during the stress of the pandemic, and now the Fed has been raising the rate in order to slow inflation.

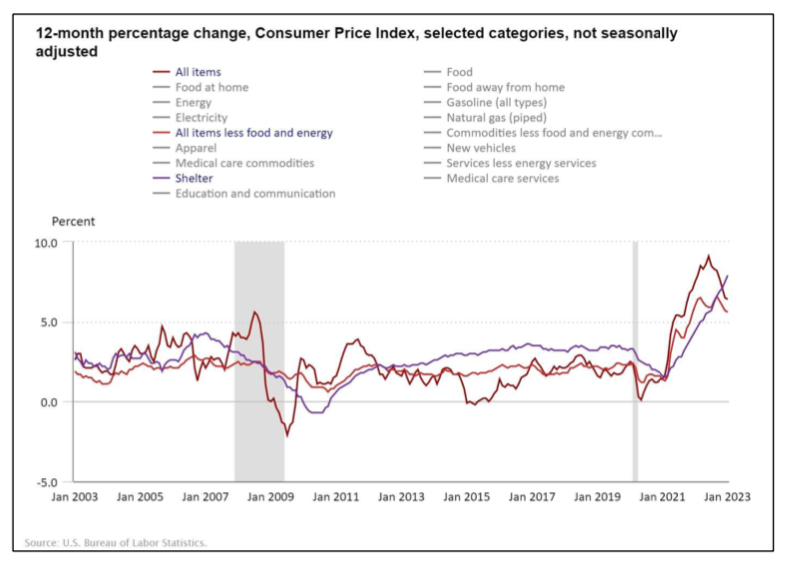

The narrative has turned more positive in 2023, with signs pointing to the possibility that inflation may have peaked in the June 2022 CPI report of 9.1% year-over-year. Inflation remains elevated, but most underlying components of the CPI have begun to decline (with the notable exception of shelter, as shown in the purple line below). Federal Reserve Chairman Jerome Powell has already softened both the pace of rate hikes, raising just 25 basis points at the February meeting, and his tone, using the world “disinflation” several times at the most recent press conference. If this trend continues, equity markets may experience more stability in 2023 than last year, which we’ve already seen evidence of more calm and rising markets in January and February.

On the other hand, Chair Powell balanced his optimism by reiterating the data dependence of the Fed. While he mentioned it was “gratifying” to see signs of disinflation without much strain in the labor market thus far, he also emphasized that inflation remains elevated, the Fed has more work to do, and it would be premature to declare victory. The Fed will continue to watch for declines in areas such as core services, where inflation has been more persistent.

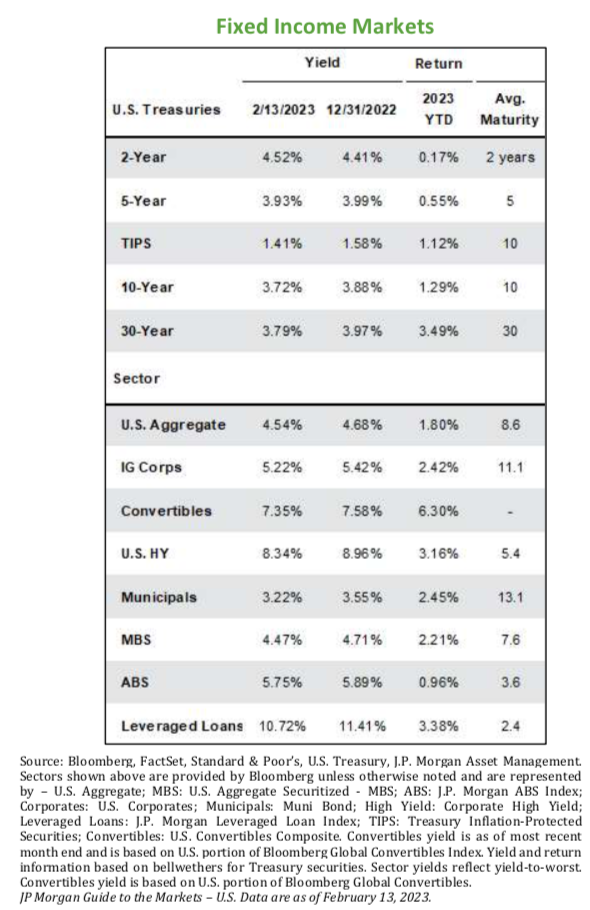

The bond market has been attempting to weigh these seemingly conflicting factors, initially rallying to begin the year (moving yields lower) before moderating and moving rates higher after the particularly strong jobs report released in early February. Market expectations, as shown by Fed Funds Futures on Bloomberg, are now pricing in a peak rate north of 5%, which would imply two or three additional 25 basis point rate hikes from the current level (the next Fed meeting is on March 22, where a 25 basis point increase is currently expected by the market). Today’s CPI report is unlikely to materially change the rate outlook, in our view, and short-term rates remain elevated at close to 5% for 1-year and shorter US Treasuries.

It is important to note that, while higher interest rates may have a slowing impact on economic growth, they are generally good for savers who can now see potentially greater return on their assets with lower levels of expected risk than 1-2 years ago. It is very possible that we will see volatility to continue as new economic data and Federal Reserve announcements are analyzed to determine the path of monetary policy for the remainder of the year, but in general, we expect 2023 to be much more calm than last year, all else equal.

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.