Executive Summary:

- The proliferation of social media over the past two decades has had a significant influence on our world, influencing what we buy, how we interact with others, who we vote for, and how we view the world.

- Despite the benefits of social media, including increased connectivity and creating a global marketplace of ideas, the algorithms and influencers that run our digital lives are optimized to maximize revenue and user engagement, not to bring people together.

- Additionally, memes can reduce complex issues or people into simple, digestible, and sometimes comical content, which is helpful for getting likes and retweets, but undermine nuance and thoughtful discussion.

- This has led, in part, to the extreme polarization that we are seeing in this country and elsewhere. We also believe that this extreme level of polarization is rippling across society, politics, and markets.

The Rise of Social Media

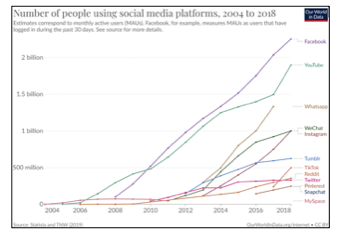

The rise of social media over the past two decades has transformed how we communicate, consume information, and engage with the world around us. Beginning with early platforms such as MySpace in the early 2000s, social media has evolved into a global phenomenon with the emergence of giants such as Facebook (Meta), Twitter (X), Instagram, YouTube, and TikTok. These platforms aimed to democratized content creation, enabling anyone with internet access to share their thoughts, images, and videos with the world.1

The rapid growth of social media was also fueled by the convergence of technological advancements, such as widespread smartphone adoption and faster internet connections, which made it easier than ever to stay connected. Social media platforms capitalized on these advancements by creating environments optimized for engagement, where users could easily interact with content through likes, shares, and comments.

In this environment a new word became part of our everyday lexicon – “meme”. Originally coined in 1976 by Richard Dawkins in his book The Selfish Gene, meme is defined as “an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.”2 Memes are similar to caricatures in that they often allow a user to convey a more complex thought in a tightly condensed, abstracted, and often comical wrapper (see right).

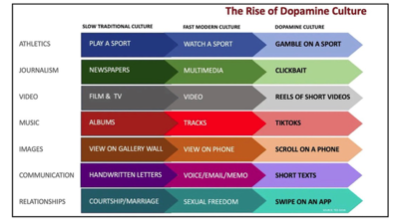

We believe memes proliferate because they are ideally suited for this fast-paced social media ecosystem – they are information-dense vehicles equipped to deliver messages across platforms with minimal effort. They also reward users who post them with likes and retweets, optimizing near-term rewards to keep users engaged. This so called “dopamine culture” incentive structure has made its way to other parts of society, as well (see right), encouraging near-term stimulation over long-term gratification.

As social media continues to evolve, its influence on culture, politics, and society remains profound, raising questions about its role in shaping our future. The same features that make social media engaging—such as personalized algorithms and viral content—have also contributed to echo chambers, polarization, and the erosion of nuance and expertise in public discourse.

Algos, Influencers, and Crowds

In Renee DiResta’s book, Invisible Rulers, she identifies the current trinity of social media – algorithms, influencers, and crowds. These three primary players profoundly impact user experiences on social media platforms, shaping not only what users see but also how they engage with content.

Algorithms are designed to prioritize content that drives engagement, often promoting posts that elicit strong emotional reactions—whether positive or negative. This priority can create echo chambers where users are exposed primarily to content that reinforces their existing beliefs, limiting diverse perspectives and contributing to polarization.

Influencers can play a significant role in shaping trends and opinions on social media by capitalizing on large followings to help sway public perception, promote products, and even influence political discourse. Influencers can provide valuable content, but their impact is often tied to commercial interests, raising concerns about authenticity and transparency. In addition, the “If you can make it trend, you make it true” ethos of many influencers prioritizes speed and spread amongst the crowd over accuracy and the public good.

Crowds, which consist of regular social media users, act as the engine that propels content and memes to virality. When algorithms surface influencers or high-engagement posts, the crowd’s reactions—likes, shares, comments, and retweets—determine how far and wide the content spreads. This collective engagement can rapidly elevate a piece of content from obscurity to widespread visibility, sometimes even influencing mainstream media narratives.

Together, these elements shape social media into a complex ecosystem where user experiences are constantly influenced by both organic and artificial forces, often blurring the lines between genuine interaction and manipulation. Additionally, the perpetual feedback loop means that each of the trinity is constantly reshaping the others. The quote, “We shape our tools and thereafter our tools shape us,” seems all too fitting.4

From the Digital World to the Real World

We have discussed how the evolution of social media has led to an environment in which echo chambers, memes, and dopamine-driven incentives are commonplace online. However, these issues are no longer confined to digital chatrooms and social media platforms. The digital world is very much a part of our natural world today. As a result, these same issues now influence our real-world decisions and behaviors, and even impact how we define our reality.

For example, “Bespoke Reality” is a term coined by Renee DiResta, used to describe echo chambers expanding to such a degree that they frame how you experience reality. She describes them as operating “with their own norms, media, trusted authorities, and frameworks of facts.”5 This phenomenon makes conversations with people who are not in your tribe difficult, as you are seemingly living in different worlds. Rusty Guinn, cofounder of Epsilon Theory, elaborates:

“The result is the increasing feeling you probably have of not understanding where many of your countrymen are coming from at all. That feeling you have that you live in different worlds with different facts and different realities. You feel that way because, in the sense that we experience facts and realities through stories and symbols, you DO live in different worlds.”6

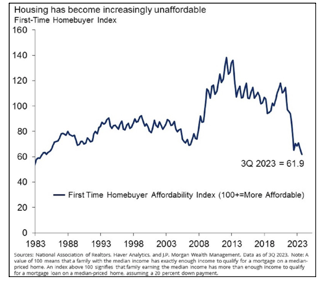

“Financial Nihilism” is another concept that has recently popped up in younger generations to describe a feeling of hopelessness tied to this moment in time. The “idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level.”7 When the American Dream seems out of reach for many people (see first time housing affordability graph at right), falling back on the immediate stimulation provided by dopamine culture – whether gambling on meme stocks, cryptocurrency, or Draft Kings – becomes much easier to justify.

Meme World – Society, Politics, and Markets

When we say Meme World, we are describing an environment in which some of the negative parts of the digital world bleed over into our society and culture at large. A world in which polarization is everywhere, abstractions of things have begun to matter more than the things themselves, and we are constantly nudged by near-term incentives.

In the Meme World:

- People are reduced to caricatures that exaggerate good or bad qualities, depending on the creator.

- The most extreme political ideas get pushed because two politicians working across the aisle on shared beliefs don’t enrage either political base.

- Sporting events are reduced to a series of moments and stats to be gambled upon rather than an opportunity to support your team.

- Investments in real-world businesses are turned into tokens and sold to us as something we should bet on rather than invest in. Why is this the world we inhabit right now? In part, we believe it’s a story of misaligned incentives. Ezra Klein said of Twitter, “Twitter rewards decent people for acting indecently.”8 We think that extends not only to other social media but to our society more broadly right now, as well. Any platform optimized for user engagement and revenue maximization needn’t focus on quality content or respectful discourse. If an enraged user is an engaged user, so be it. Nowhere is this Meme World polarization more evident in the real world than in US politics. We touched on this topic in last year’s Knife Fight piece, but unfortunately, the situation has only intensified since.9 Despite the calls for unity and turning down the rhetoric after the assassination attempts on Donald Trump, both parties continue to frame their opponents as existential threats to our democracy.

This environment informs the actions of politicians, pushing them to more extreme views. Ben Hunt, in his 2022 piece The Widening Gyre, pointed out that this polarizing environment can get people, including politicians, to act in ways they would not otherwise, encouraging a perversion of the Golden Rule: “Do unto others as they would do unto you. But do it first.”10

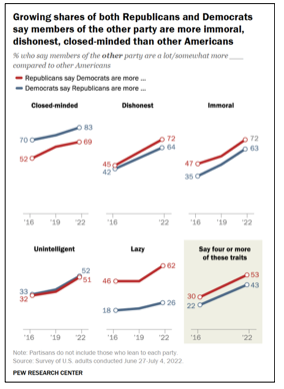

And there are real-world consequences to this rhetoric and behavior. For example, see the Pew Research Center graphic at right indicating how Americans feel about opposing party members. When we reference the quote about living in different worlds above, this is what we mean. Suppose everyone, in what is essentially a two-party system, believes the other side to be too unintelligent, dishonest, and immoral to govern. How can we expect to ever solve the big issues that this country faces?

We believe that some elements of the Meme World, such as distilling complex investment ideas into tokens and encouraging short-term speculation, have made their way into markets, as well. The most obvious example is meme stocks themselves. Beginning in late 2020, investment groups formed on social media platforms such as Reddit’s WallStreetBets coordinated purchases of a handful of stocks such as GameStop, AMC, Blackberry, and Bed, Bath and Beyond, pushing stock prices higher initially. What followed was extreme volatility in the relatively small stocks, with some making money while others taking significant losses.11

Beyond just meme stocks, cryptocurrency is another example of a good idea turned into a token to be gambled upon. We believe that blockchain is a novel concept with real-world applications and some currencies, such as Bitcoin, can serve an economic purpose as well (although others, such as Dogecoin, not so much). Cryptocurrencies may be hard to value, but some have real potential economic use cases. Unfortunately, coins typically trade in much the same way as meme stocks today – with significant volatility, driven more by hype and speculation than any underlying fundamental data or economic purpose.

One last example of the Meme World creeping into real-world markets that affects far more investors is artificial intelligence (AI). We believe that AI represents an incredible technological leap, that practical applications will proliferate across industries, and that AI will act as a tailwind for the economy and markets for decades. In fact, we use ChatGPT 4-o to help research papers, such as this one, and to learn more about a variety of topics.

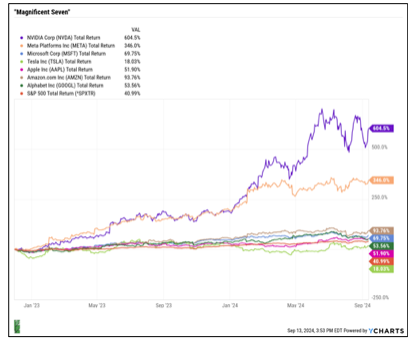

However, the hype surrounding AI since the launch of ChatGPT has manifested itself almost entirely in just a handful of large US technology stocks thus far. The performance of this group, commonly referred to as the “Magnificent Seven,” is shown at right. All but Tesla have outpaced the S&P 500 since late 2022, and Nvidia is up over 600% during that time!

Again, we believe that excitement about AI is warranted, and Nvidia, for example, is a well-run industry leader positioned to capitalize on growth in AI moving forward. However, we see some similarities in the hype around Nvidia and what we described with meme stocks and cryptocurrencies.

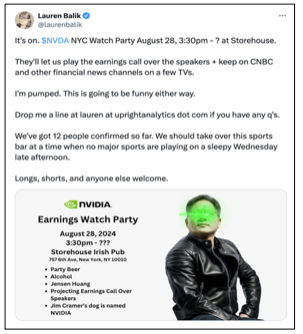

Take Nvidia’s August earnings call as a prime example. Publicly traded companies typically hold quarterly earnings calls to discuss their performance, to provide updates on projects, and to discuss expectations going forward. These calls are normally pretty dull affairs, important to investors, but generally confined to the Wall Street crowd.

However, there was so much anticipation before Nvidia’s August earnings call that the call was expected to move the stock by 10% one way or the other, depending on the news. That translates to over $300 billion either being created or destroyed for shareholders based on just one call.12 There was so much interest in Nvidia’s earnings, in fact, that the tweet at right was forwarded to me by a colleague commenting, in jest, “This seems totally normal.”

The Path Forward

So, how do we navigate this polarized, memeified, and dopamine-driven environment? How do we maintain our autonomy of mind, rather than outsourcing our thoughts and feelings to algorithms, influencers, and crowds?

We suggest the following as a start:

- In Society – Prioritizing real engagement, respecting and listening to others, and recognizing the nudge of misaligned incentives.

- In Politics – Not allowing a party line to define you, respecting the opinions of others, and rejecting the memes and caricatures as the equivalents of complex issues and people.

- In Markets – Ignoring FOMO (fear of missing out) reflex in market media, refusing to performance-chase expensively priced assets, prioritizing time in the market rather than timing the market, and building a financial plan worth investing in. If we, investors and advisors alike, remember that investments serve to support a financial plan and not the reverse, it would be a step in the right direction. We’ve found that the concept of “funded contentment,” defined as “the ability to underwrite a meaningful life,” is what most people seek.13 Working toward funded contentment, which is our recommended strategy for surviving the Meme World of markets, takes thoughtful planning and patience. As always, we appreciate your trust in our firm as we navigate the complexities of today’s investment landscape. We remain committed to making prudent, impactful decisions on your behalf, and we look forward to continuing our partnership in the years to come. ~ Brett Greenfield

1 Source: https://en.wikipedia.org/wiki/Social_media

2 Source: https://en.wikipedia.org/wiki/Meme

3 Source: Invisible Rulers, Renee DiResta

4 Source: Attributed to Father John Culkin, amongst others

5 Source: https://www.jasonscottmontoya.com/others/society/661-bespoke-realities

6 Source: https://www.epsilontheory.com/we-are-losing-our-minds/

7 Source: https://www.epsilontheory.com/financial-nihilism/

8 Source: https://www.nytimes.com/2022/04/27/opinion/elon-musk-twitter.html

9 Source: https://investmentresearchpartners.com/insight/debt-ceiling-update-knife-fight-january-31-2023/

10 Source: https://www.epsilontheory.com/the-widening-gyre/

11 Source: https://www.forbes.com/sites/investor-hub/article/what-is-a-memestock/#:~:text=“A%20meme%20stock%20is%20any,%2C”%20according%20to%20Britannica%20Money.

12 Source: https://www.bloomberg.com/news/newsletters/2024-08-27/nvidia-s-expected-310-billion-move-to-drive-broader-

13 Source: Shaping Wealth https://www.shapingwealth.com

The views expressed in this piece are the author’s and may not represent the opinion of Investment Research Partners. The views are as of the date listed on the material and are subject to change based on changes in fundamental economic or market-related data. Forecasts regarding the market, economy, and individual securities are subject to a wide range of possible outcomes. Past performance may not be representative of future results, and all investments are subject to loss. This piece is not intended as individualized investment advice. Before participating in any investment program or making any investment, readers are encouraged to consult with their own professional advisers, including investment advisers and tax professionals.