Recent events in the banking sector and continued market volatility raised questions regarding whether the Federal Reserve would continue its planned interest rate increases to fight inflation. Some of those questions were answered after Wednesday’s meeting, as the Fed raised the target interest rate another 25 basis points, its 9th consecutive increase. Chairman Powell acknowledged that financial conditions have tightened due to recent events, and markets interpreted his comments as a potential pause in rate hikes on the horizon.

This week’s regularly scheduled Federal Reserve (Fed) meeting came at an interesting time after a banking crisis broke out earlier this month and threw a wrench into the Fed’s previously well-telegraphed inflation-fighting plan. Our Banking Industry Note published on March 13 describes how fear and lack of confidence contributed to the liquidity issues and ultimate FDIC takeover of two major banks. Interest rates also played an important role, as the banks were facing significant losses in their bond portfolios despite holding the highest quality, “risk-free” securities, US Treasuries, and agency mortgages. In other words, losses were not a result of credit issues or bad loans, but rather the Fed’s dramatic rate increases last year which caused the value of existing holdings with lower yields to decrease (prices and yields have an inverse relationship; higher rates = lower prices). These banks were forced to realize losses on securities they would have otherwise held to maturity to shore up liquidity as depositors pulled money, which led to a spiraling crisis of confidence and a “run on the bank”.

This has led to much uncertainty in the financial sector – other banks are sitting on unrealized losses from the big move in rates, are they at risk, too? The Fed quickly stepped in to quell this concern by creating a new liquidity facility allowing banks to borrow against their high-quality

assets at par value (as opposed to the market value, which would be much lower)1. This went a long way in stabilizing markets, implicitly safeguarding deposits, and attempting to mitigate any wider contagion. Volatility has continued, though, and regional banks in particular have been under tremendous pressure as investors consider both immediate and long-term consequences. Banks will likely take a more conservative stance going forward, effectively tightening financial conditions and possibly bringing down inflation. Will this alter the near-term path of the Fed, which has been raising interest rates to achieve the same goal?

In the long run, regional banks will almost certainly face additional regulation and scrutiny surrounding their liquidity, deposit base, loans, investment securities, and policies. We will be watching closely for investment opportunities, which are likely to arise as some banks or other financial institutions are unduly punished by the broader turmoil.

What does this all mean for the bond market and the Fed?

Prior to the shock in the banking sector earlier this month, fixed income market participants were squarely focused on the Fed and its primary goal to down inflation, seemingly at any cost. February CPI and jobs market data mainly was in line with expectations and did not show a need for the Fed to change its “higher for longer” narrative: inflation is coming down but remains elevated and persistent in areas such as shelter; the job market remains resilient and unemployment is near record lows; there may still be more work to do to bring prices down.

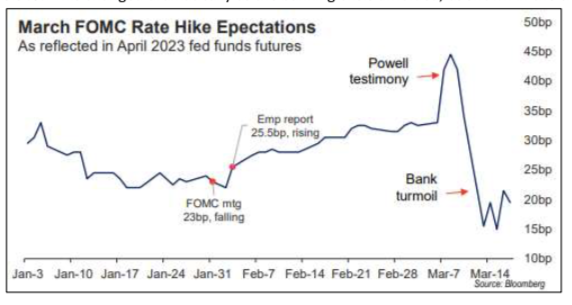

As of March 9th, Fed Funds futures were pricing in a 25 basis point increase at this week’s meeting with 100% certainty, with a 50/50 chance of a 50 basis point increase. The peak terminal rate at that time was expected to be approximately 5.50%. This changed dramatically as the banking crisis unfolded, as shown in the chart below2, and yields moved with volatility not seen in more than 30 years as participants tried to determine how (or if) this would change the Fed’s path. Would the Fed need to abandon its fight against inflation to stabilize the banking industry? Would this crisis spread to other banks or financial markets?

In the flight to safety that ensued, two- year Treasury note yields, which had been trading north of 5%, fell in historic fashion, dropping more than 120 basis points over the span of just a few trading days. They continued to trade in a roughly 30 basis point range each day throughout the week, which is highly unusual for what is typically a relatively stable security. Fed Funds futures started pricing in the possibility of a Fed pause (no increase at this meeting), and the expected terminal rate fell well below 5%.

Against this backdrop, the Fed’s decision-making becomes more complicated and it’s messaging even more critical to guide market expectations. This week’s Federal Reserve announcement and press conference provided a few answers as to how the Fed’s thinking has changed (and not changed) in the short time since the banking crisis began:

- No material net change to their forecasted path of rate hikes; inflation remains in focus

The Fed moved forward with the 25 basis point hike, increasing the Fed funds target rate to a range of 4.75% to 5.00%. Consensus projections from the Committee did not materially change from the December meeting, due to what Chairman Powell referred to as “offsetting factors”. He emphasized that inflation data since the last meeting has actually pointed to higher inflation, and bringing that down remains a key focus: “The process of bringing inflation down has a long way to go and is likely to be bumpy.” - Shifting language surrounding forward guidance

On the other hand, Powell made several references to the recent events in the banking industry as being likely to tighten credit conditions, however, it is too soon to determine the full effect. For that reason, they changed the statement to remove the language “ongoing rate increases will be appropriate” and replace it with “additional policy firming may be appropriate”. He explained that the credit tightening could serve as a substitute for future rate hikes depending on the extent and duration of the effects on the economy. This change seems to give the Fed flexibility for future meetings as they will be closely watching how lending and credit conditions are impacted, and the effect on the broader economy (e.g. inflation data, unemployment). He emphasized that they still think a path to a soft landing exists, and they are not forecasting any rate cuts this year in their base case.

- Emphasis on stability and safety in the banking sector

Chair Powell began his press conference with a statement to reassure the market: banks are safe, ample liquidity is available, and all deposits in the banking system are secure. The Fed has demonstrated an ability and willingness to use all available tools to avoid any contagion and believes the serious problems are limited to a small number of banks. When asked directly, Powell stopped short of stating explicitly that deposits over the FDIC limit of $250,000 are guaranteed, as it is likely that Congress would have to enact such a change, but repeated his comment that “depositors should assume their deposits are safe”. He said that deposit outflows have stabilized. - No change to unemployment forecast in Summary of Economic Projections (SEP)

While unemployment remains near historically low levels at 3.6%, the SEP showed the Fed still forecasting an increase to 4.5% unemployment by the end of the year. When asked about the pain that this significant increase would cause, Chair Powell essentially explained that the pain from high inflation would be worse for the average American. The jobs market has not shown signs of softening yet, but it is clearly an area the Fed is closely watching. - References to the war in Ukraine were removed from the official statement

The banking sector crisis has taken center stage as a risk for financial markets, pushing geopolitical events to the side for now. The prior meeting’s statement included a reference to Russia’s war against Ukraine causing elevated uncertainty, economic and human hardship, and possibly contributing to higher inflation.

As frequently happens on Fed meeting day, markets were moving rapidly after both the statement release (2 PM) and during the press conference shortly thereafter (beginning at 2:30 PM), shown on the intraday chart of the S&P 500, below3. These knee-jerk reactions tend to level out, and we will be watching for signs of longer-term trends as the information is fully digested. We will continue to monitor financial markets, Federal Reserve activity, and the latest economic data as it relates to your portfolio. Please do not hesitate to reach out to us to discuss your goals at your convenience.

1 Federal Reserve Board – Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.