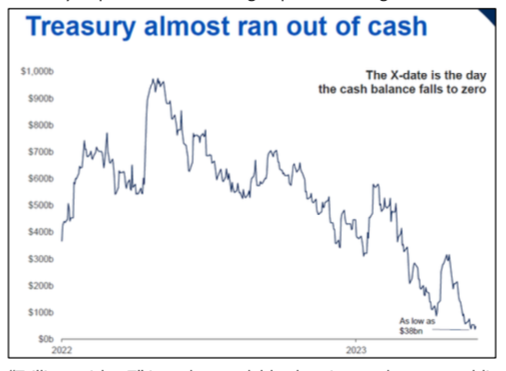

In the aftermath of the politically contentious and headline-grabbing debt ceiling debate, one of the areas of potential fallout lies in the Treasury market as the government must now refill its cash balance which reached dangerously low levels. Now that the debt ceiling has been raised through 2025, the Treasury plans to increase its short-term bill issuance to raise funds to the tune of an estimated $1 trillion. This is a large number, to be sure, but we believe it’s less scary than it sounds as the market is well-positioned to absorb the additional issuance without dislocation.

The debt ceiling headlines are behind us (for a year or two, at least), but the down-to-the-wire negotiations left the Treasury Department scrambling to preserve the government’s relatively low cash balance until the debt ceiling was

officially raised earlier this month. Fortunately, we no longer have to ponder the hypothetical dilemma of which bills the Treasury Department will choose to pay when we reach the “x-date” when the US government was set to officially run out of money. Even the “x- date” itself was far from clear, causing significant confusion and concern (see our comprehensive notes from May and January if interested in a deep-dive look back on the debt ceiling crisis). 1

The next potentially headline-grabbing “crisis”, if the media is looking for one, could be shaping up in the Treasury bill market as the government must rebuild its typically large cash balance for day-to-day funding. Some market participants have estimated the new bill issuance may reach as large as $1 trillion. Seeing

“Trillion, with a T” is understandably alarming, and some troubling news coverage has been circulating, as evidenced by the following quotes, all taken from one Bloomberg article published on June 6th:

- “Trillion-Dollar Treasury Vacuum Coming for Wall Street Rally”

- “…the US Treasury is about to unleash a tsunami of new bonds to quickly refill its coffers.”

- “…could wreak havoc…”

- “Treasury will kick off a borrowing spree…”

- “The negative impact could easily dwarf the after-effects of previous standoffs over debt limit.”2

While there is certainly the potential for some market dislocation, we do not think this level of concern is warranted for several reasons. First, the expansive size of the Treasury market overall is not frequently discussed, so let’s put the dreaded $1 trillion figure in context. According to SIFMA, there was over $24 trillion in Treasury securities outstanding as of April of this year. Year-to-date issuance through May, before any resolution of the debt ceiling when the Treasury was still implementing its “extraordinary measures” to preserve cash, was $8 trillion.3 Treasury bill auction sizes can regularly exceed $40 billion each, so while the auction sizes will be increasing incrementally, this is a market that is accustomed to large deal sizes.

Secondly, the Treasury Department has some flexibility in this unprecedented situation to rebuild its cash position in the least disruptive way possible. So far, the Treasury has announced that it will gradually increase bill issuance over a period of several months, with the expectation for the Treasury’s cash balance to normalize by the end of September. In addition, the Treasury Department has committed to monitoring market conditions and adjusting issuance plans, if necessary.4 In other words, if the larger T-bill auctions are not being well received or are causing significant market dislocation, the Treasury reserves the right to dial it back a bit and reconsider how to best raise cash.

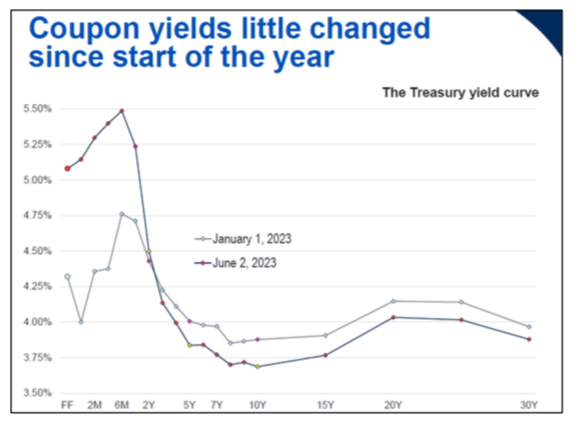

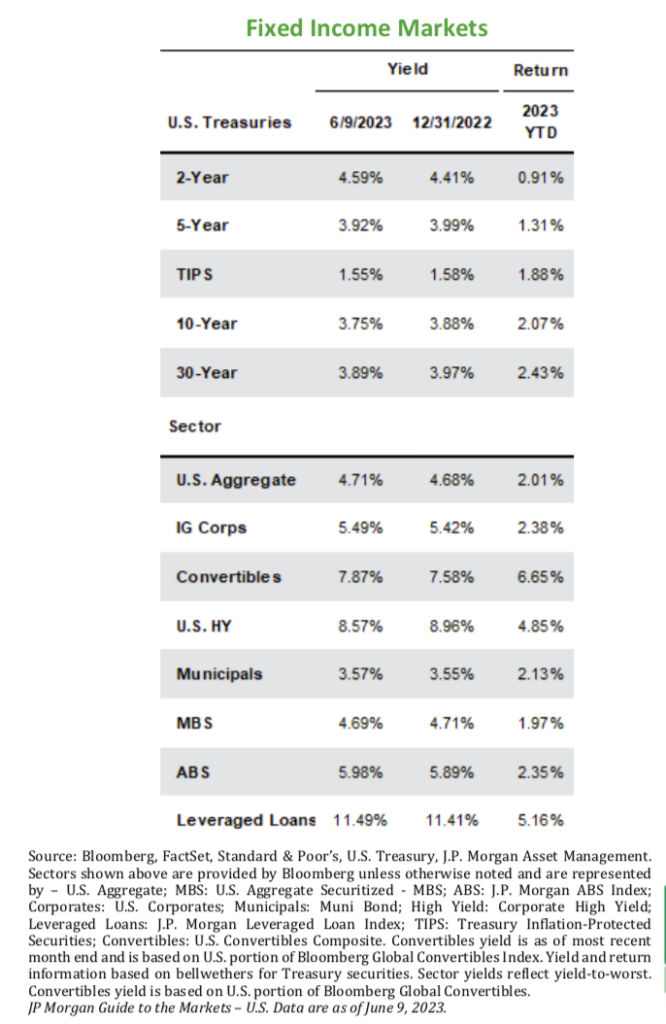

Finally, we believe that despite the concerns listed, the market currently is well positioned to absorb the larger bill auction sizes. As a forward-looking mechanism, the Treasury yield curve has adjusted over the last several months in response to the Federal Reserve continuing to raise the target interest rate as well as the debt ceiling debacle. Yields on the short end of the maturity spectrum, especially two years and shorter, have increased at a much wider margin than the longer end of the maturity curve, as shown in the chart at right.5 This means that investors are being compensated with higher yields (returns) for taking on any additional perceived risk associated with the government’s elevated Treasury issuance. We believe these higher yields, in excess of 5% currently, coupled with significant demand for short, high- quality assets (as shown by the large cash and money market balances) will be enticing enough for investors to gobble up the additional Treasury bill supply over the next few months.6 Early indications are good for auctions so far this month, with completed auctions as large as $65 billion being smoothly accepted by dealers and investors.

While the media narrative may continue surrounding the large Treasury issuance, it is our opinion that market focus will return to the Federal Reserve (Fed) and its continued fight against inflation. Prices have been coming down, but at a frustratingly slow pace for the Fed. A pivotal read on inflation was released this week, showing an increase of 4.0% in the Consumer Price Index year-over-year. This shows significant improvement compared to the 9% prints of last summer, but it is still far from the Fed’s 2% target and some components, including shelter, remain stubbornly high. The next Fed meeting announcement is this week on Wednesday, June 14th, and while the Fed may hold off on raising rates for the first time since early 2022, it is likely that Chair Powell will signal that there is still work to do. Market participants will also scour the newly released “dot plot”, or Fed forecast, for hints on the rate path for the rest of 2023 and beyond. Markets have been adjusting closer to the Fed’s “higher for longer” narrative, and Fed funds futures are now pricing in 5% rates for the better part of the year.7 The good news for investors is that high-quality, conservative investments are available for relatively attractive yields, and fixed income can once again play its traditional roles in portfolios, including diversification, income, and stability. As always, please feel free to reach out to us if you would like to discuss your personal investments.

1 Chart Source: FHN Financial, US Department of the Treasury

2 Trillion-Dollar Treasury Vacuum Coming for Wall Street Rally – Bloomberg

3 US Treasury Securities Statistics – SIFMA – US Treasury Securities Statistics – SIFMA

4 Treasury Provides Additional Guidance on Bill Issuance and Cash Balance

5 Chart Source: FHN Financial, Federal Reserve as of June 2, 2023

6 Minutes of the Meeting of the Treasury Borrowing Advisory Committee May 2, 2023 | U.S. Department of the Treasury

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.